A Cautious Start to 2026 - with Growing Leverage for Buyers

January opened with limited momentum across the Fraser Valley. Home prices continued to soften while inventory remained elevated, keeping market conditions firmly tilted toward buyers. Despite what would normally be considered favourable buying conditions, ongoing economic uncertainty and affordability pressures are continuing to temper buyer confidence.

Across the Fraser Valley

The Fraser Valley Real Estate Board recorded 619 MLS® sales in January, a 33% decrease from December and 24% lower than January 2025, reflecting a quieter-than-usual start to the year.

New listings rose sharply to 3,078, following typical seasonal patterns, while overall inventory climbed to 7,711 active listings - 54% above the 10-year seasonal average.

With a sales-to-active listings ratio of just 8%, the Fraser Valley remains firmly in buyer’s market territory (a balanced market is typically between 12%–20%).

Benchmark prices continued their gradual decline, with the composite Fraser Valley benchmark price at $897,200, down 1.0% month-over-month and 6.9% year-over-year - the first time below $900,000 since spring 2021.

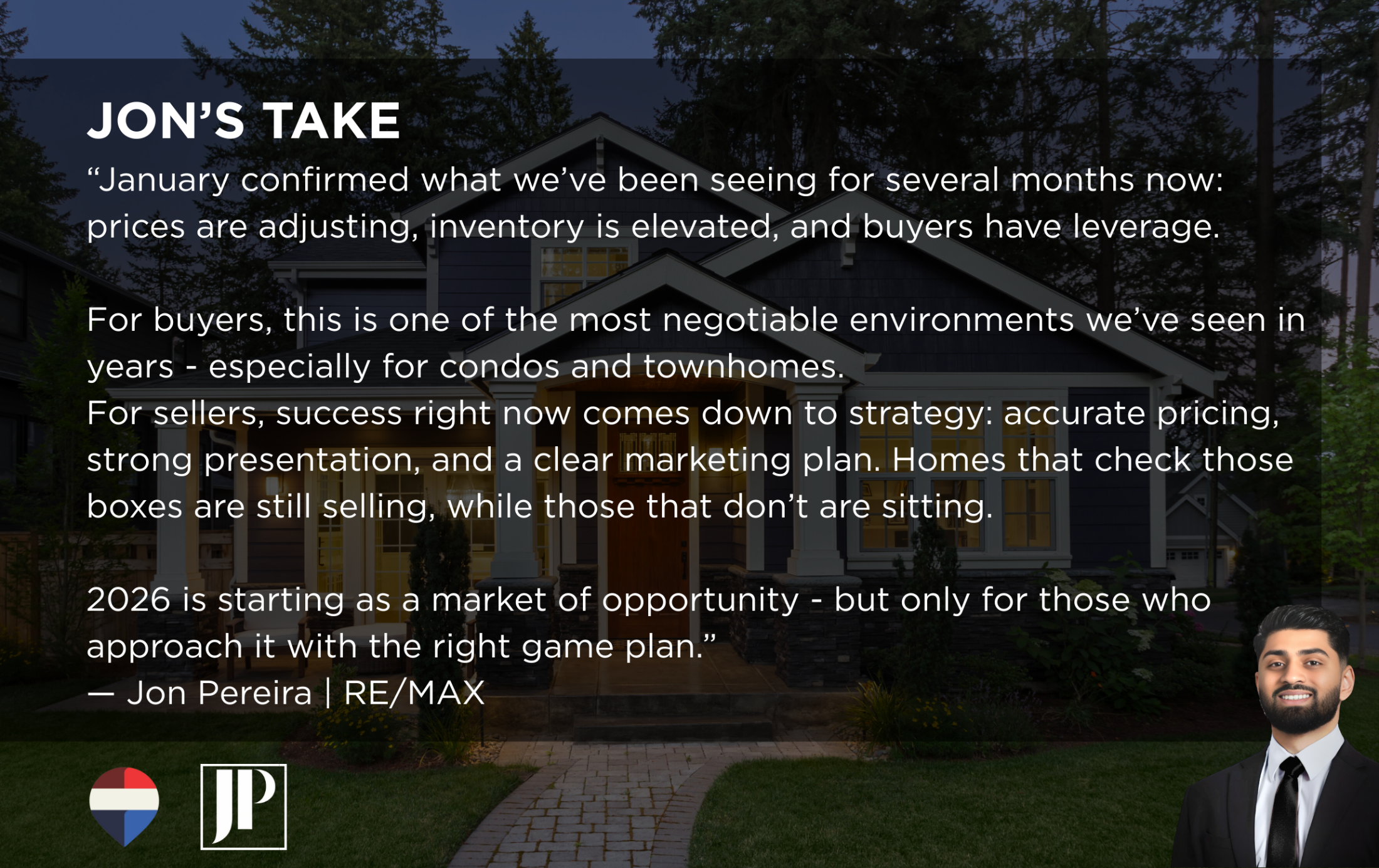

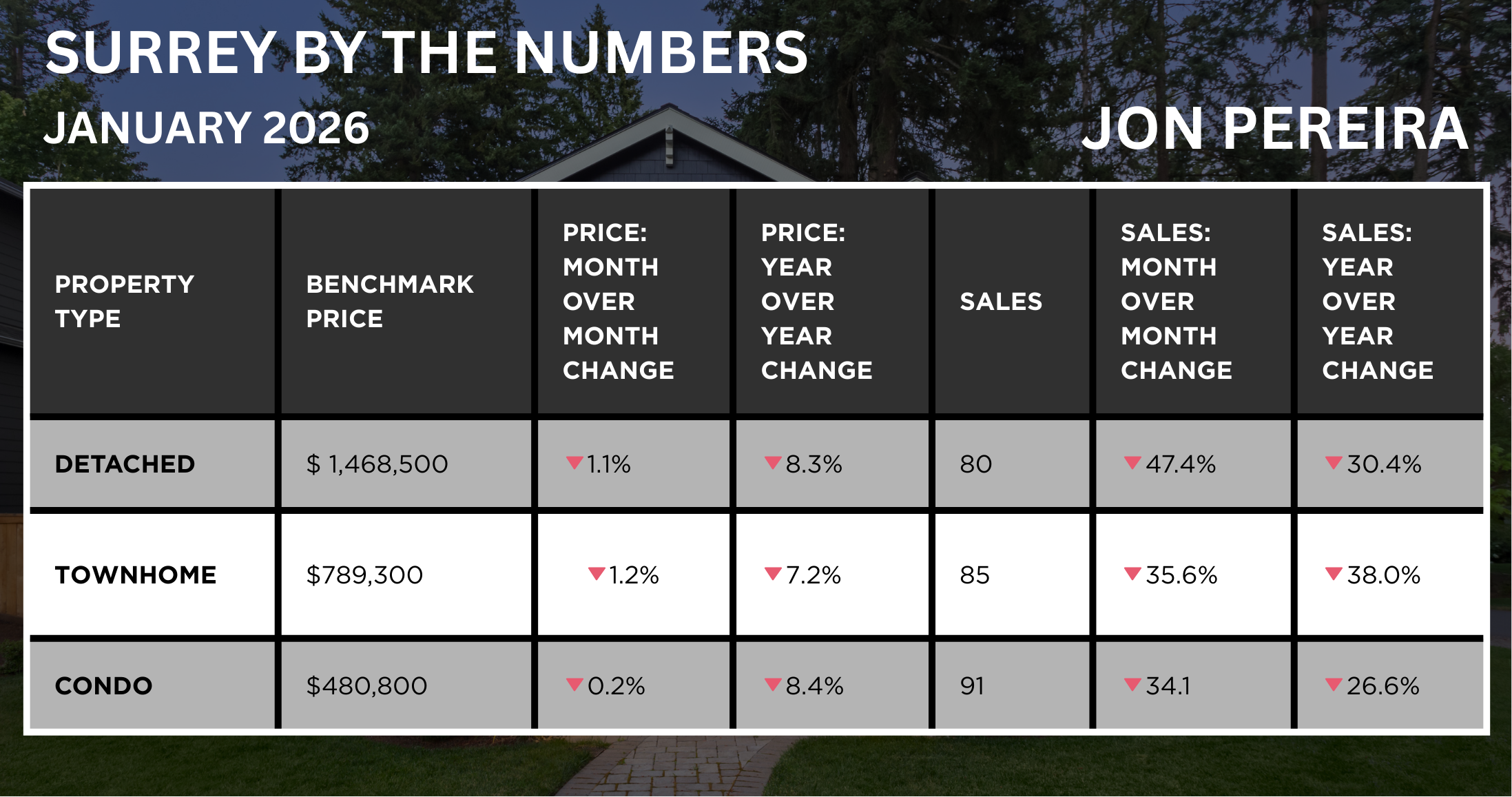

A Closer Look at Surrey

Detached benchmark prices in Surrey declined 1.1% month-over-month, sitting at $1,468,500, down 8.3% year-over-year

Townhome benchmark prices decreased 1.2% month-over-month to $789,300, down 7.2% year-over-year

Apartment benchmark prices dipped 0.2% month-over-month to $480,800, down 8.4% year-over-year

Sales activity in Surrey slowed across all property types, but well-priced homes continue to sell - particularly in townhomes and entry-level apartments where buyers are most active.